Understanding the concept of double materiality

One fundamental concept underlying the CSRD is “double materiality”. The materiality assessment is the process used to determine the relevant matters a company should report on in terms of sustainability impacts, risks and opportunities.The term “double” refers to the fact that the assessment needs to look at how sustainability issues may affect their company (‘outside-in risks’), as well as how the company affects society and environment (‘inside-out risks’). The company should report on all the impact, risk and opportunities (IROs) which are found to be material (aka relevant) from a financial perspective (outside-in), impact perspective (inside-out) or both.

There is no mandatory set process for the double materiality assessment, but to meet ESRS requirements, the process should include:

• An explanation of the context

• Identification of actual and potential impacts, risks and opportunities in relation to sustainability matters

• Assessment of material IROs related to sustainability matters

• Reporting on them

In order to identify actual and potential impacts and prioritise them for reporting, a company will need to engage with its stakeholders, like employees, investors, and customers. Suppliers, including farmers, also represent key stakeholders for food and beverage companies. The engagement can be done in a number of different ways including surveys, focus groups and more. Following the stakeholder engagement, the company will define what to report on based on the severity and likelihood of the impacts, risks and opportunities identified.

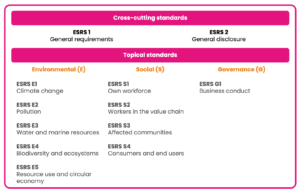

The process used to conduct the double materiality assessment needs to be disclosed as part of the general disclosure (ESRS 2 IRO1). Additionally, within the ESRS 2, general disclosure, the company needs to show the interaction between IROs and its own strategy and business model (ESRS 2 SBM3), as well as the disclosure for each of the sustainability statements (ESRS 2 IRO2).